MAT Submission Instructions

HOW TO ACCESS THE REMITTANCE FORM

1. Go to the MAT Registration and Submission Link on the City of Vaughan MAT website

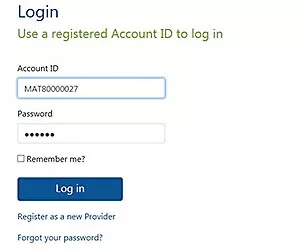

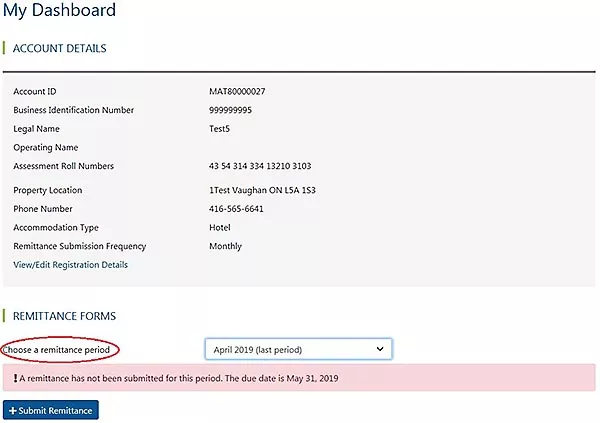

2. Log into the MAT account by using the MAT ID assigned and password setup during the registration process.

3. Select the remittance period in the “Remittance Forms” section and click on the “Submit Remittance” button.

HOW TO COMPLETE THE REMITTANCE FORM

The following section pertains to Hotels

Any personal information on this form is collected under the authority of By-law 029-2019, By-law to Impose Municipal Accommodation Tax (MAT) on the purchase of transient accommodation in the City of Vaughan. The personal information will be used for administration of the MAT collection.

- Remittance Period:

- Select the remittance period

- If remittance is submitted before the due date, changes are allowed until the due date

- Remittance period will remain open until submission is received even after the due date. Once overdue remittance is submitted, no changes are allowed.

- Box “A”: Enter number of rooms available

- Box “B”: Enter number of room nights sold in the reporting period

- Box “C”: Enter the average daily rate for the room nights sold

- Box “D”: Enter the amount of revenue received in the reporting period. If no tax was collected in the reporting period enter ‘0’

- Box “E”: Enter the amount of exemptions in the reporting period. List of exemptions can be found in By-law 029-2019

- Box “F”: Enter the amount of adjustments to the revenue associated to before or/and the reporting period. It can be positive or negative. If an amount is inputted, an explanation is required.

- Box “G”: Calculation based on the amounts in Box “D”, “E” and “F”

- Box “H”: Calculation based on 4% of amount in Box “G” (Room revenue subject to Municipal Accommodation Tax)

- Payment Method:

- Cheque

- Cheque is payable to the City of Vaughan and please indicate your MAT ID on the front of the cheque

- Attach a copy of the submission confirmation with the cheque

- Mail your cheque to

Attn: Maureen Zabiuk

City of Vaughan, Financial Services

2141 Major Mackenzie Dr

Vaughan ON L6A 1T1

- Online payment through the bank or Electronic Fund Transfer (EFT) Payment

- For more details, please contact us at mat@vaughan.ca or 905-832-2281

- Not Applicable

- Please choose this option if the value in Box “H” is equal to or less than ‘0’

- Cheque

Submission Timeline for Hotels

- A Municipal Accommodation Tax Return form must be completed and received by the City by the last day of every month for the previous month's reporting period even if no tax was collected. For example: April's monthly tax return (April 1st to April 30th) must be received by May 31st. If the form is remitted quarterly, it must be remitted by April 30th, July 31st, October 31st and January 31st(of the following year) of the MAT collected for the previous 3 months. Late payment charges will be charged on outstanding balances as outlined in the By-law 029-2019.

The following section pertains to Short Term Rental (STR) Operators and Brokers

License Status has impact on the remittance period can be selected

| Licence Status | Remittance period |

|---|---|

| License- Approved | Remitting period starting from license issued onward |

| License- Expired | Remitting period starting from license issued to expired |

| License- Revoked | Remitting period starting from license issued to revoked |

| License- Denial | No Remittance allowed |

| License- Appealed | Remitting period starting from license issued to appealed |

Any personal information on this form is collected under the authority of By-law 152-2019, By-law 158-2019 and By-law 183-2019, By-law to Impose Municipal Accommodation Tax (MAT) By-law to Impose Municipal Accommodation Tax (MAT) on the purchase of transient accommodation in the City of Vaughan. The personal information will be used for administration of the MAT collection.

- Remittance Period:

- Select the remittance period

- If remittance is submitted before the due date, changes are allowed until the due date

- Remittance period will remain open until submission is received even after the due date. Once overdue remittance is submitted, no changes are allowed.

- Box “A”: Enter number of rooms available for rental

- Box “B”: Enter number of room nights booked for all available rooms in the reporting period

- Box “C”: Enter the average daily rate for the room nights sold

- Box “D”: Enter the amount of revenue received in the reporting period. If no tax was collected in the reporting period enter ‘0’

- Box “E”: Enter the amount of adjustments to the revenue associated to before or/and the reporting period. It can be positive or negative. If an amount is inputted, an explanation is required.

- Box “F”: Calculation based on the amounts in Box “D” and “E”

- Box “G”: Calculation based on 4% of amount in Box “F” (Room revenue subject to Municipal Accommodation Tax)

- Payment Method:

- Cheque

- Cheque is payable to the City of Vaughan and please indicate your MAT ID on the front of the cheque

- Attach a copy of the submission confirmation with the cheque

- Mail your cheque to

Attn: Maureen Zabiuk

City of Vaughan, Financial Services

2141 Major Mackenzie Dr

Vaughan ON L6A 1T1

- Online payment through the bank or Electronic Fund Transfer (EFT) Payment

- For more details, please contact us at mat@vaughan.ca or 905-832-2281

- Not Applicable

- Please choose this option if the value in Box “G” is equal to or less than ‘0’

- Cheque

Submission Timeline for Short-Term Rental Property

- A Municipal Accommodation Tax Return form must be remitted quarterly - by April 30th, July 31st, October 31st and January 31st (of the following year) for the MAT collected for the previous 3 months. The form must be completed and received by the City by the last day of every month for the previous reporting period even if no tax was collected. Late payment charges will be charged on outstanding balances as outlined in By-law 183-2019.