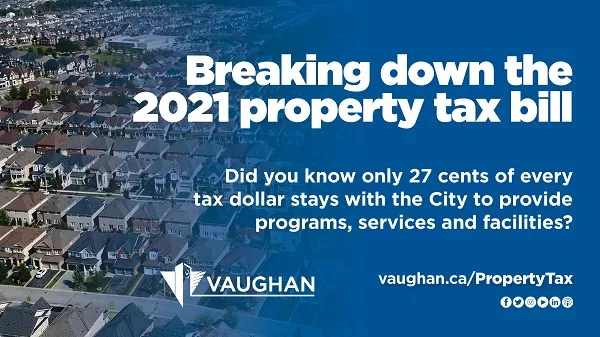

Breaking down the 2021 property tax bill

Do you know where your tax dollars go? Although the property tax bill may come in a Vaughan envelope, only 27 cents of every dollar stay with the City of Vaughan to provide programs, services and facilities. As the last instalment of the final residential property tax deadline approaches, the City is encouraging citizens to learn more about their bill breakdown, find out how their hard-earned money is being invested and explore the many payment options available – including online banking, pre-authorized programs or mail. Get started at vaughan.ca/PropertyTax.

The City’s 2021 final residential and non-residential property tax bills were mailed to all Vaughan property owners in June. The due date for the next residential final property tax bill payment is Wednesday, Sept. 29. The due dates for non-residential final property tax bill payments are:

- Second instalment – Wednesday, Sept. 29

- Third instalment – Thursday, Oct. 28

If you did not receive your tax bill in the mail, contact the City immediately at 905-832-2281 or accessvaughan@vaughan.ca. Failure to receive a tax bill does not exempt you from paying property taxes – late payment penalties will be incurred.

MANY PAYMENT OPTIONS AVAILABLE

While Vaughan City Hall remains closed, there are many easy and convenient ways property owners can make payments:

- Pre-authorized payment plans: The City offers two options that include –

- *NEW* 10 instalments: As the City has transitioned to a new tax system, there are only 10 withdrawals/payments for 2021 instead of the usual 11. The bill sent in February outlined the instalment dates from March 1 to July 1, 2021. The final property tax bill mailed in June outlines the instalment dates from Aug. 1 to Dec. 1, 2021. Your account must be at a zero-dollar balance in order to qualify.

- Six instalments: The interim and final billing tax instalments are withdrawn automatically from the selected bank account on each due date. Your tax account must be at a zero-dollar balance to qualify for this program.

- Post-dated cheques: Post-dated cheques corresponding with the amounts and due dates printed on the tax stubs can be used. Please include all tax stubs with the cheques as applicable when sending to the City. A fee will apply if any post-dated cheques need to be sent back.

- Financial institutions: Taxes can be paid at all major banks either in-person, through the bank machine, online or via telephone. Payments will also be accepted from any other financial institution that will facilitate tax payments. Some financial institutions may charge a fee for this service.

- At City Hall: Drop-off boxes at each Vaughan City Hall entrance can be used for submitting cheques. The boxes are emptied at least twice a day. Cash should not be dropped off in these boxes.

- By mail: Cheques and money orders should be made payable to the City of Vaughan and mailed to Vaughan City Hall in the return envelope enclosed with your tax bill, in addition to the payment stub. Please mail early as payments delayed in the mail and received after the due date will be subject to a penalty charge. Do not send cash through the mail.

BREAKING DOWN THE YEARLY TAX BILL

- 49 cents to York Region

- 27 cents to City of Vaughan

- 23 cents to local school boards (Province of Ontario for education purposes)

- One cent to the Hospital Precinct Levy

Municipal services in Vaughan are provided by two tiers of government – the City of Vaughan and York Region. The City retains approximately $1,600 of an average $6,000 annual property tax bill to support critical services that residents rely on each day, including Vaughan Fire and Rescue Service; public works and road services; waste management; infrastructure replacement; maintenance of City facilities; city planning and development; Building Code enforcement; and by-law and compliance. These important services and more remain operational during the COVID-19 pandemic.

Unanimously approved by Mayor Maurizio Bevilacqua and Members of Council on Dec. 15, 2020, the Council-approved 2021 Budget and 2022 Financial Plan delivers on the City’s mission of Citizens First Through Service Excellence. It balances the needs of managing unprecedented growth, investing in infrastructure and supporting economic development – all while respecting citizens’ hard-earned tax dollars throughout the global COVID-19 pandemic. As outlined in the plan, a zero per cent increase to the property tax rate is reflected in the 2021 final bill calculation.

2022 BUDGET PROCESS – HAVE YOUR SAY

The City’s annual budget process is open and transparent, with public consultation being a vital component. A key priority is to educate the public about the process – to ensure they are informed and have multiple opportunities to comment on the budget and how the City spends their tax dollars. This includes educating stakeholders on how property taxes and water and wastewater rates are allocated. The annual Budget Book (PDF) provides an overview of the budget and this process.

Planning is underway for the 2022 budget process. Public meetings will be held to discuss the budget on the below dates and times:

- Special Committee of the Whole (Public Meeting) on Wednesday, Dec. 1 at 7 p.m.

- Special Committee of the Whole (Public Meeting) on Tuesday, Dec. 7 at 7 p.m.

- Special Council Meeting to approve the budget on Thursday, Dec. 9 at 7 p.m.